Innovating the Rental Industry

RentZoot’s innovative approach to verifying potential tenants' information in real time, lets you focus on keeping your business profitable. Let’s face it, in today’s fast paced and ever changing rental market, it’s critical to have the right information, when you need it and how you need it. We’ve taken the guesswork out of verifying a potential tenant by verifying pay check stubs against direct deposits through their bank account – that’s only 1 part. With income fraud on the rise, RentZoot’s income verification takes a big step towards combating fraud and that can save you tens of thousands in lost rental income.

Learn more below on why RentZoot is more advanced and a better solution.

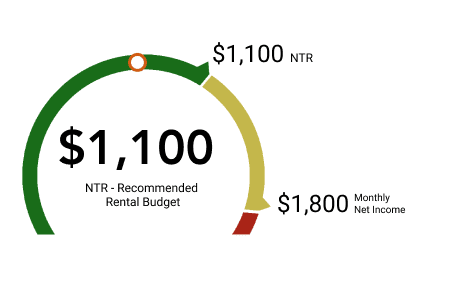

Net To Rent®

NTR® looks at the net income, fixed and variable expenses and compares them to rental price with a proprietary algorithm. We provide a visual range to showcase a renter's optimal rental budget recommendation (in green).

The yellow represents the caution or stretched budget range, where a renter has the income to cover but it's likely much of that is going to other monthly expenses. The red range represents the over budget range, where the potential renter does not have the necessary means to pay for rent when compared to their income.

Example:

3 people applied for a rental property and each earn a GROSS income of $74,000 per year. Those 3 people all get paid a different NET income, likely due to various conditions including: medical insurance, 401K contributions, commuter benefits, etc. A tenant screening company only provides you with the information a tenant provides them and it's not verified.

RentZoot provides a much more authentic financial view to render a more realistic recommendation.

RentZoot Verification Badge

Verified: The Tenant's information has been verified

Verified: The Tenant's information has been verified

Zooted: All the Tenant's information has been verified AND they have a 600 minimum credit score

Zooted: All the Tenant's information has been verified AND they have a 600 minimum credit score

Zooted Prime: All the Tenant's information has been verified AND they have a 680 minimum credit score

Zooted Prime: All the Tenant's information has been verified AND they have a 680 minimum credit score

Gross Annual Income: $75,000

Gross Monthly Income: $6,250

Net Monthly Income: $4,375

NTR® Optimal Budget: $3,000

Gross Annual Income: $75,000

Gross Monthly Income: $6,250

Net Monthly Income: $5,650

NTR® Optimal Budget: $4,100

Gross Annual Income: $75,000

Gross Monthly Income: $6,250

Net Monthly Income: $4,900

NTR® Optimal Budget: $3,600

ADDITIONAL FEATURES

State of the Industry

We're here to help during these tough times. We want landlords, realtors, and renters to all make smart financial decisions, keep their personal information secure, and give everyone a chance to take control of their financial data. This year, we're going to see a lot of unknowns, shifts in the rental industry, evictions, and Covid related loss of income. The majority of those affected by Covid related job loss are concerned about their credit and unemployment and how this will affect their ability to recover, the longevity of its effects and ultimately how to show landlords and creditors their financial worthiness. RentZoot's mission is to be a platform to give control and knowledge over financial data so everyone can come out ahead.

Provide more insight and control over financial information

Provide more insight and control over financial information

Provides the ability for a renter to explain their situation that may not be apparent by a credit score. Such as, circumstances beyond their control like the Covid crisis

Provides the ability for a renter to explain their situation that may not be apparent by a credit score. Such as, circumstances beyond their control like the Covid crisis

Provides a complete picture of a person's financial worthiness

Provides a complete picture of a person's financial worthiness

Gives the ability to explain unemployment due to circumstances beyond their control.

Gives the ability to explain unemployment due to circumstances beyond their control.

Protects against income fraud and identity theft

Protects against income fraud and identity theft

Limits bias, gives transparency, and decreases risk for everyone

Limits bias, gives transparency, and decreases risk for everyone

Partner With Us

Want to know more on how you can best use RentZoot? Contact us to learn more about partnering.